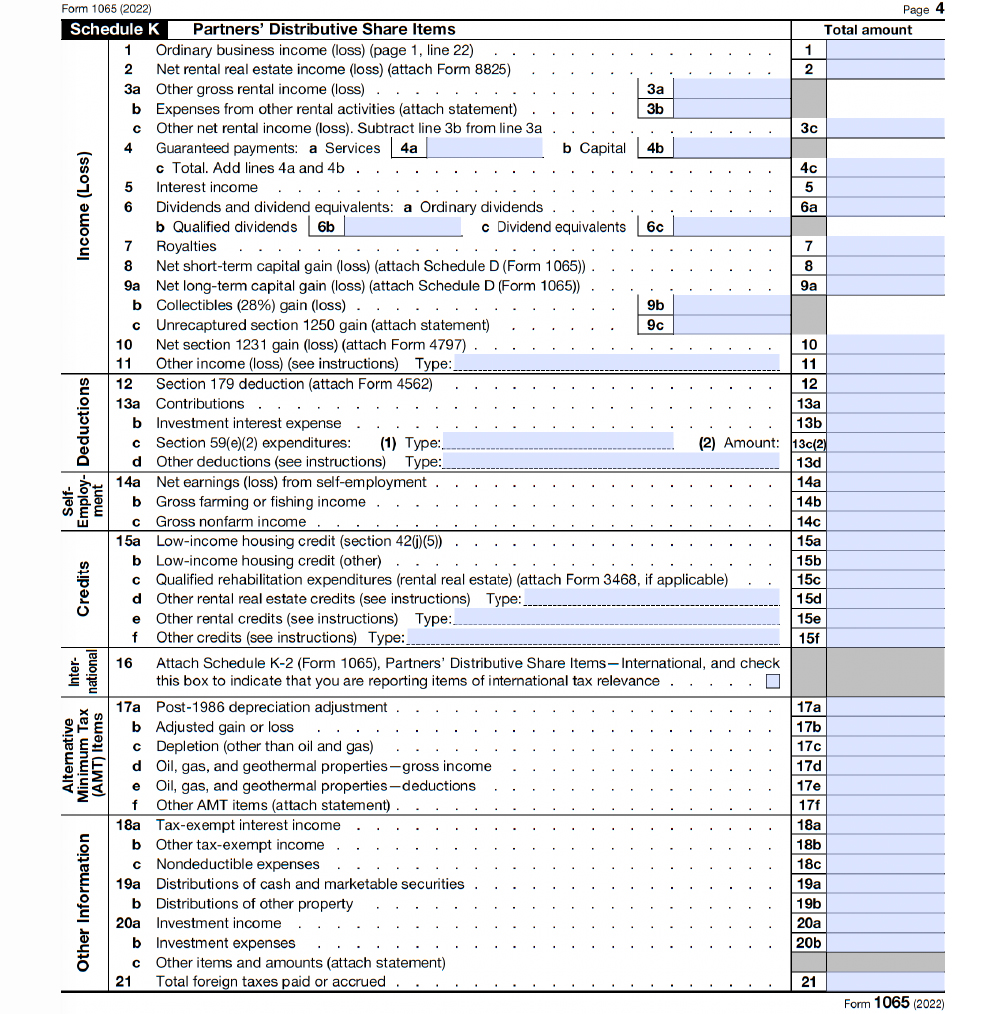

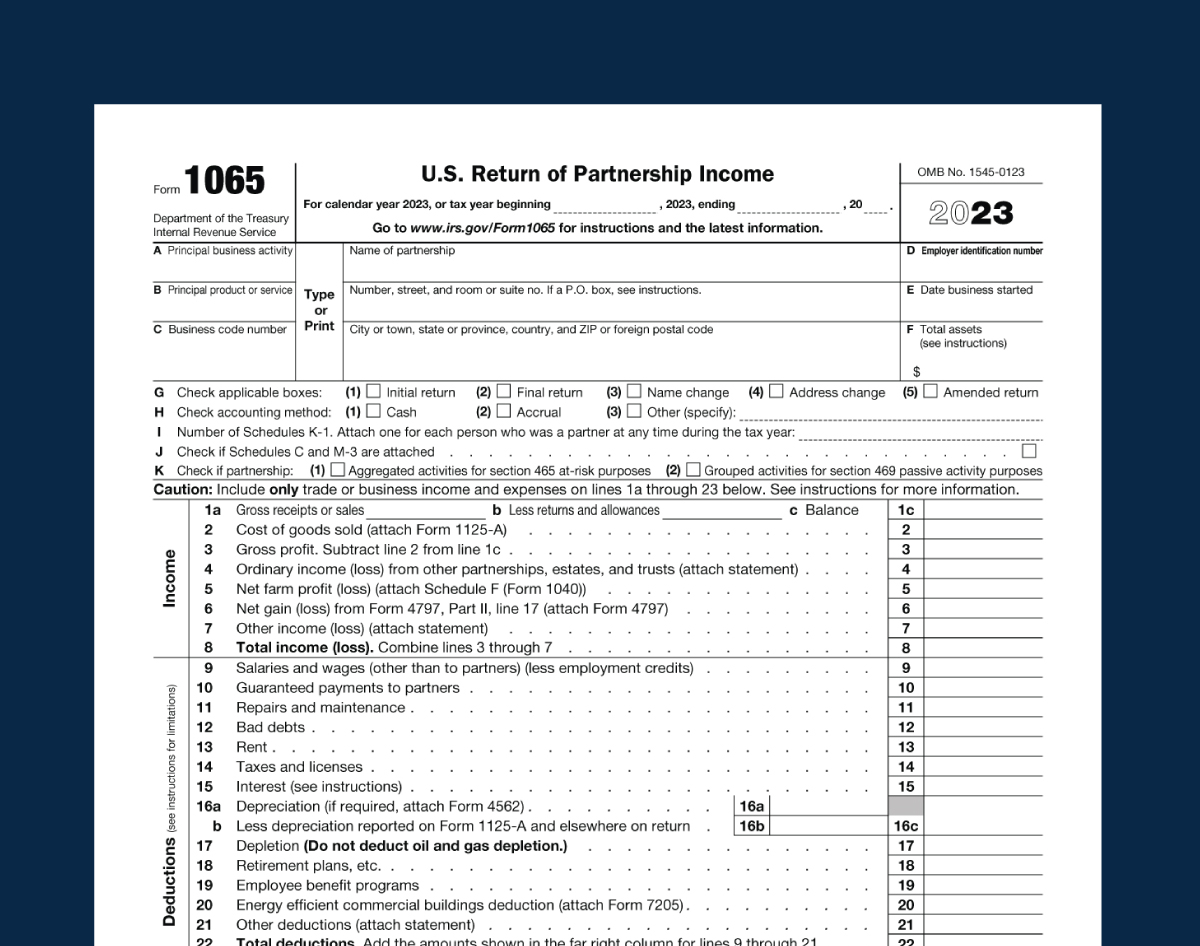

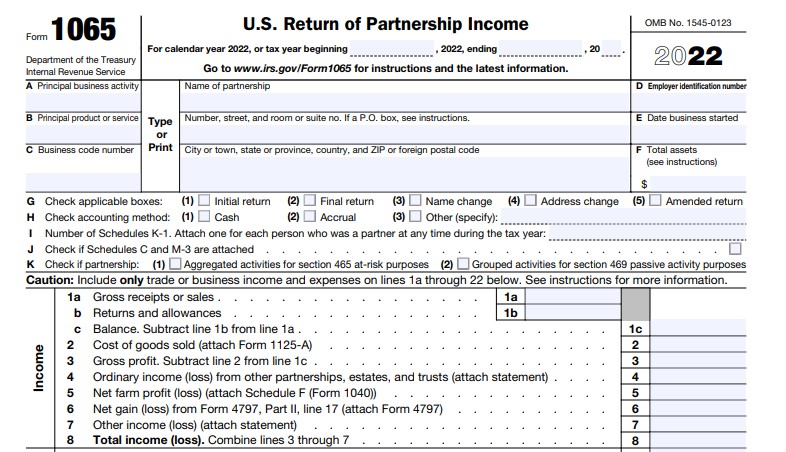

2024 Form 1065 Schedule K-11 – Schedule K-1 (Form 1065) If you receive income from a partnership, the IRS will send you schedule K-1 every tax year. You do not return this form to the IRS. Instead, you use schedule K-1 as a . Partnerships generally don’t pay taxes and use Form 1065 to prepare Schedule K-1s (and Schedule K-3s, where appropriate) to pass-through income and losses to partners. • Partnerships must file .

2024 Form 1065 Schedule K-11

Source : lili.co1065K11204 Form 1065 Schedule K 1 Partner’s Share of Income

Source : www.greatland.comSchedule K 1 (Form 1065) Partnership (Overview) – Support

Source : support.taxslayer.com1065K11204 Form 1065 Schedule K 1 Partner’s Share of Income

Source : www.greatland.comForm 1065 Instructions: U.S. Return of Partnership Income

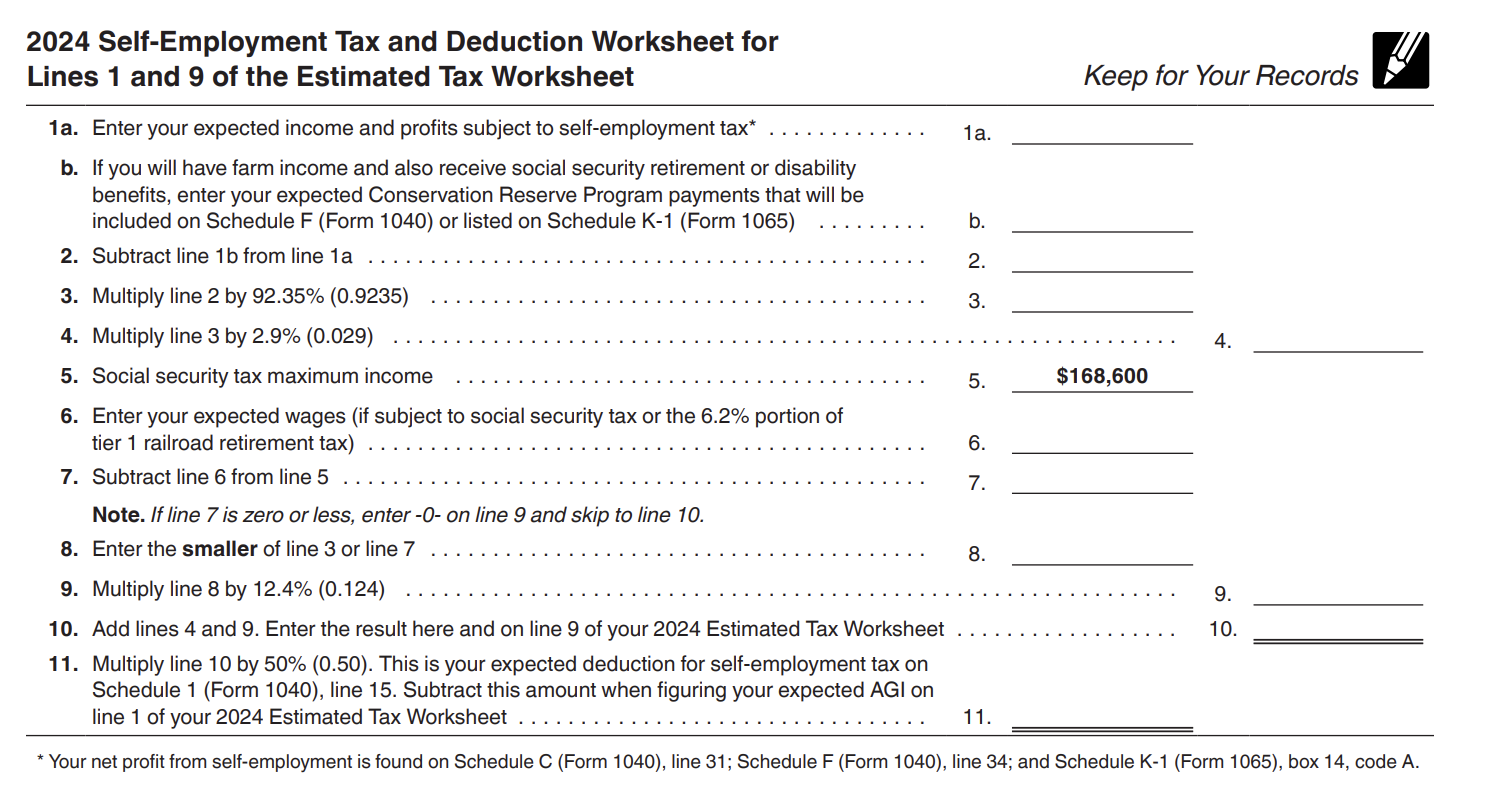

Source : lili.coEstimated Taxes, Due Dates and Safe Harbor Tax Rules (2024)

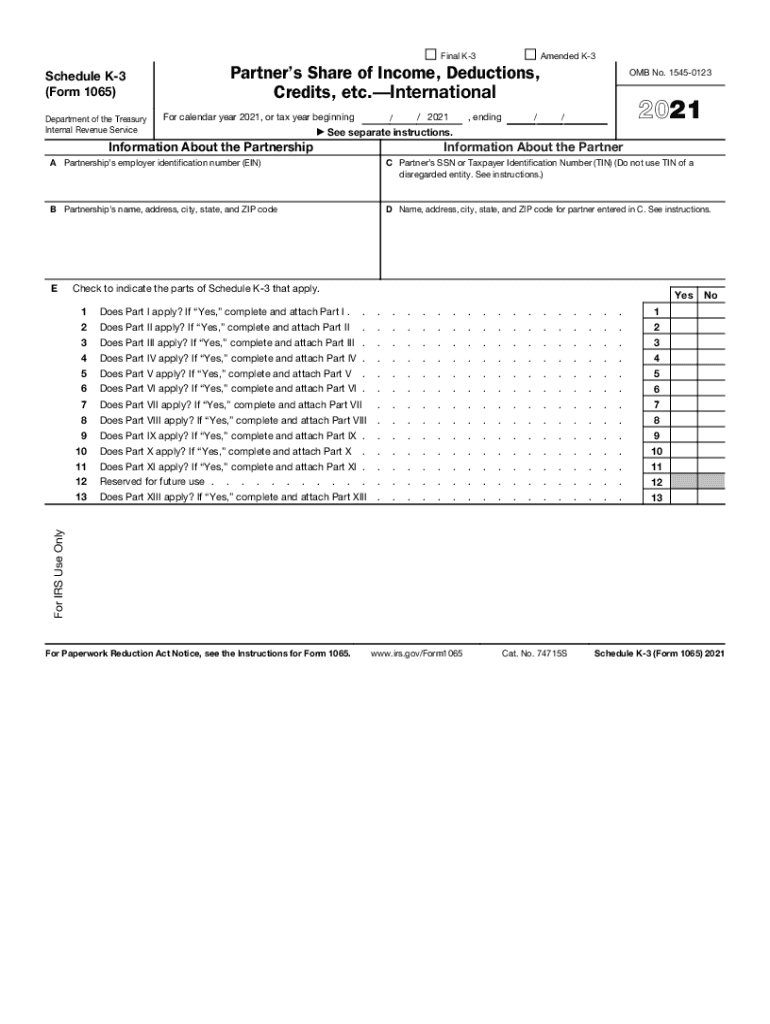

Source : wallethacks.comComplying with new schedules K 2 and K 3

Source : www.thetaxadviser.comSchedule k 3 is attached if checked: Fill out & sign online | DocHub

Source : www.dochub.comForm 1065 Step by Step Instructions (+Free Checklist) for 2024

Source : fitsmallbusiness.comComplying with new schedules K 2 and K 3

Source : www.thetaxadviser.com2024 Form 1065 Schedule K-11 Form 1065 Instructions: U.S. Return of Partnership Income: Schedule K-1 Tax Form for Inheritance vs. Schedule K-1 (Form 1065) Schedule K-1 can refer to more than one type of tax form and it’s important to understand how they differ. While Schedule K-1 . You should continue to fill out the form just as if the partnership is ongoing and be sure to file your form 1065 Schedule K-1s to the partners. 3. Check the box located in G, 2 on Form 1065. .

]]>